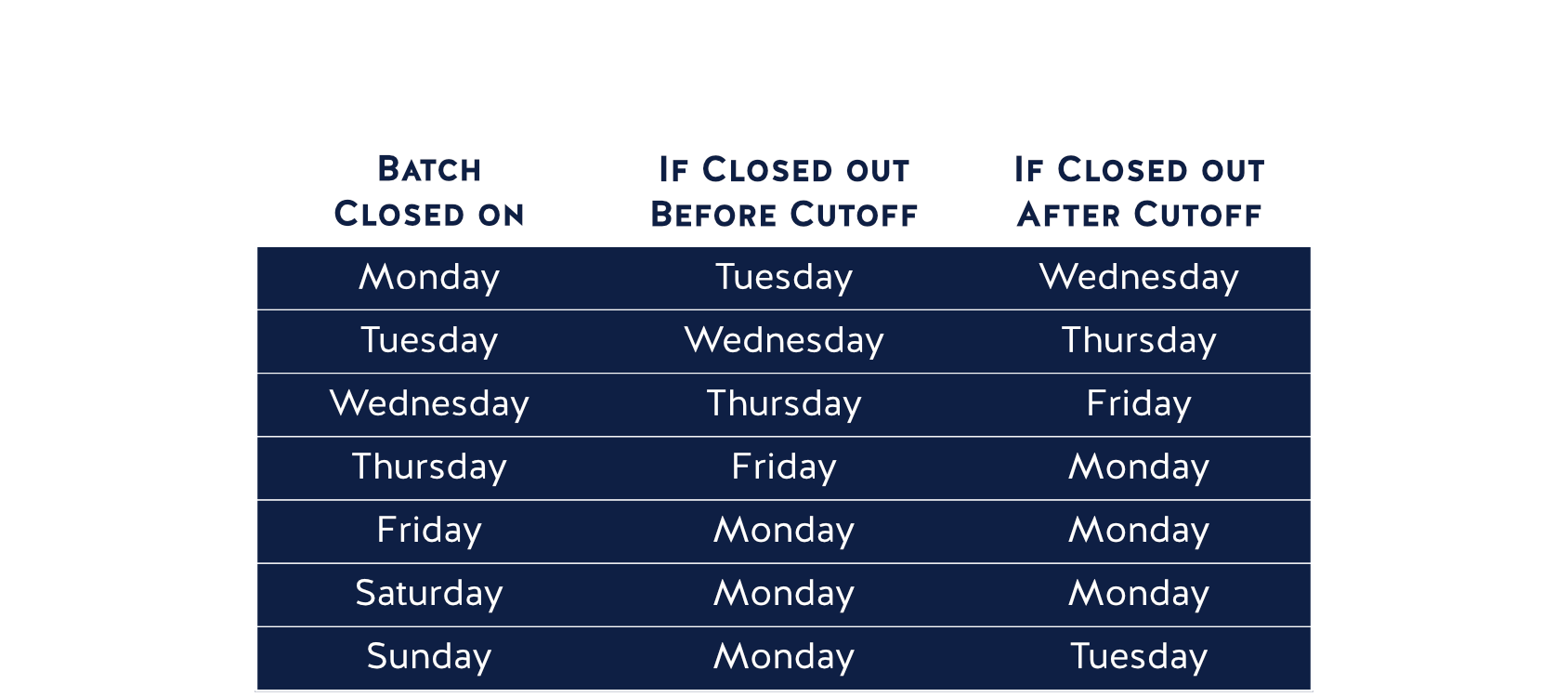

Deposit Schedule

With VersiPay, next day funding (NDF) is standard. That means that if you batch out your daily sales before the cutoff time on Monday, the bank will process your batch that day, and the funds will be available in your bank account Tuesday morning. If the batch isn’t sent to the bank until after their cutoff time on Monday, then the batch wouldn’t get processed until Tuesday, and those funds would be available in your account on Wednesday morning.

Most banks don’t process deposits on the weekend, so batches submitted on Friday or Saturday will be processed by the bank on Monday morning and deposited that day.

As you can see, the batch submission cutoff time is an important factor in determining when you will receive your credit card deposit. Processor cutoff times vary, and generally correspond to the closing time of the bank. For the vast majority of hospitality businesses that operate into the evening hours, a batch submitted after you close for the night will have missed the NDF window and will be processed when the banks reopen on the next business day. If you are unsure of your business’ deposit cutoff time please reach out to our support team and we can help to make sure you know exactly when this cutoff occurs.

The chart below can help you identify when to expect your credit card deposits. Remember that if your batch is submitted after your cutoff time, the bank will consider it to have been submitted on the next business day. If your cutoff time is 4:00 PM on Monday and you close your batch at 4:05 PM, the bank will consider that batch to have been submitted on Tuesday.